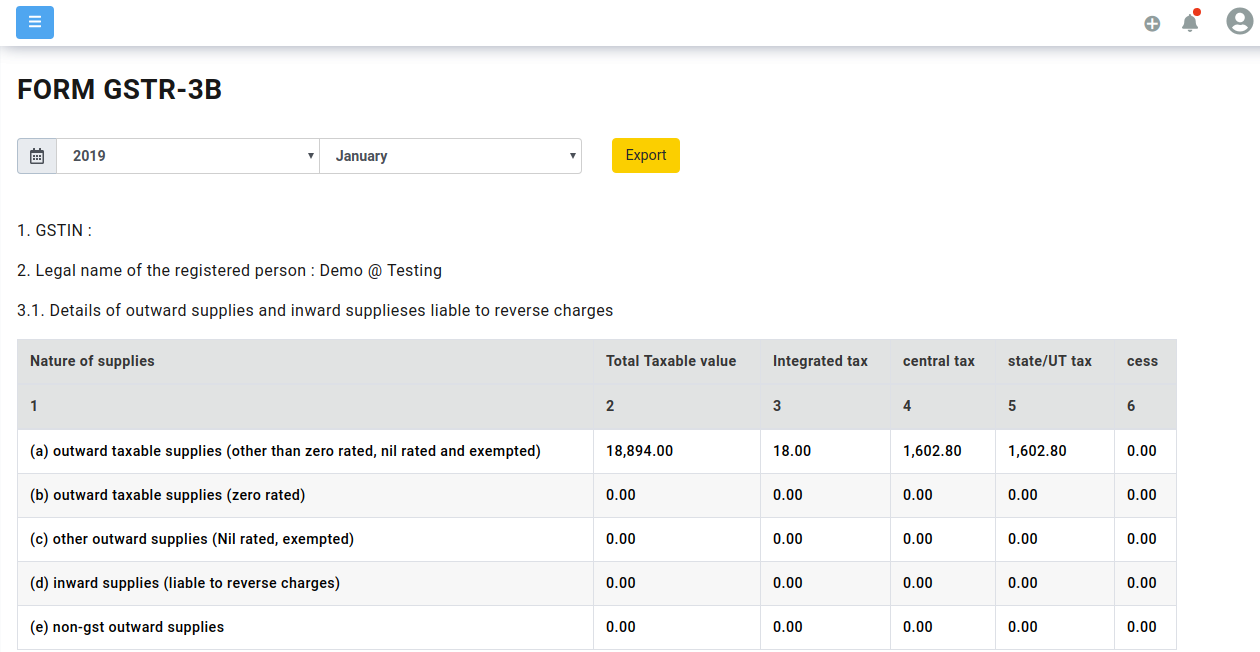

GSTR-3B monthly

The GSTR 3B is a simple tax return form introduced by the Central Board of Excise and Customs (CBEC) for the month of July and August. In the interim, all GST registrants have to file GSTR-3B form. It is must that you have a separate GSTR 3B file for each Goods and Services Tax Identification Number (GSTIN) you have.

Generate GSTR-3B report today

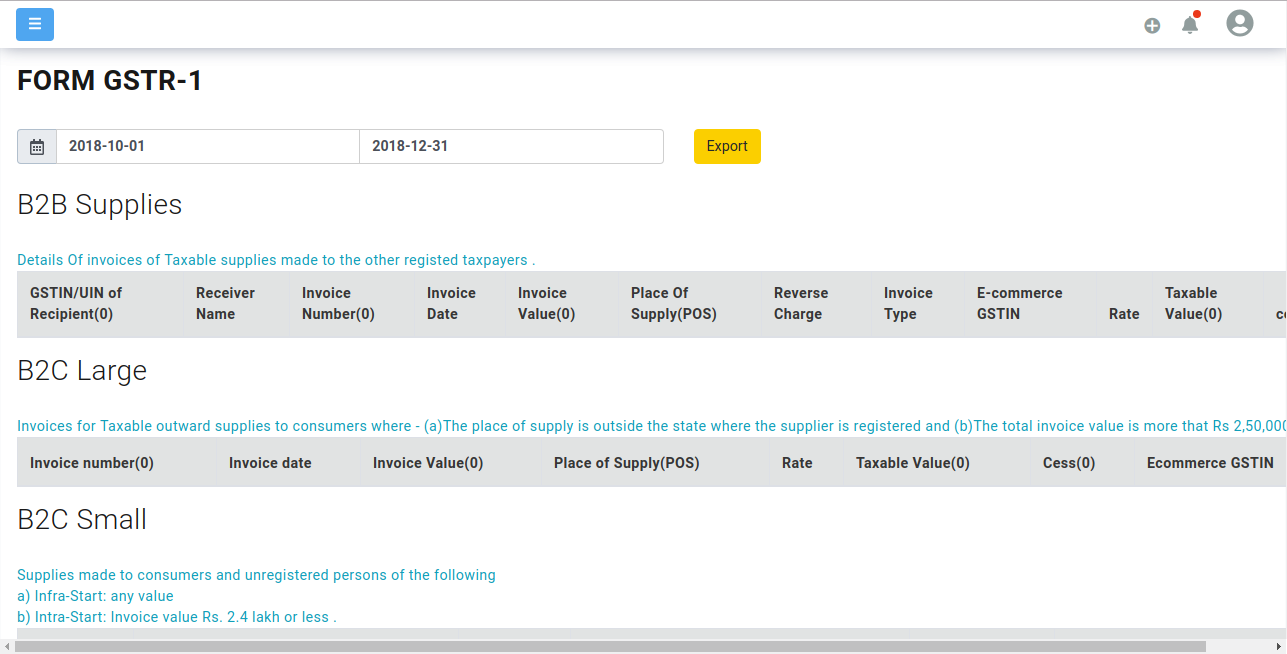

GSTR-1 monthly / quarterly

GSTR -1 is a monthly or quarterly return that should be filed buy every registered dealer. It contains details of all outward supplies i.e sales.

- The return has total of 13 sections.

- When is GSTR-1 due?

- The due dates for gstr-1 are based on your turnover

- Business with sales of up to rs.1.5 crore will file quarterly returns.

- Other taxpayers with sales above rs.1.5 crore have to file monthly return.

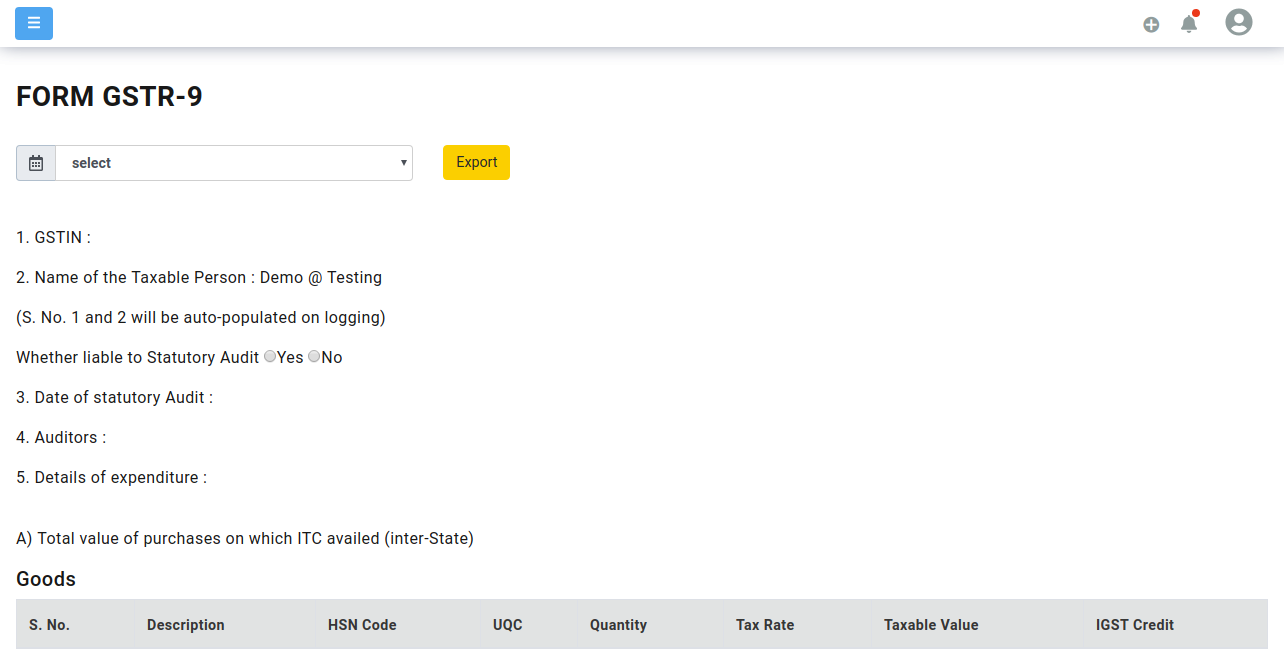

GSTR 9 annual

The GSTR 9 is a GST annual return form to be filed by the regular taxpayer once a year with all the consolidated details of SGST, CGST and IGST paid during the year. The eligible taxpayers can download and view the GSTR 9 form in PDF format.

Generate GSTR-2 report today

Reconciling GSTRs Coming Soon

GST reports should be reconcilled to understand there are no ommision or addition from your side while filling. Let's consider when your vendors file their GSTR-1 against you, your accounting software should have a correct record of that too. These problems can be solved by reconciling.

Other Accounting Reports Viz: Trial Balance, P&L, Balancesheet

GST reports should be reconcilled to understand there are no ommision or addition from your side while filling. Let's consider when your vendors file their GSTR-1 against you, your accounting software should have a correct record of that too. These problems can be solved by reconciling.

Read more

Get Started with GST Reports Today

Want to move from your existing accounting solution? Tell us which accounting solution are you using, and our technical and business team will help you from there..