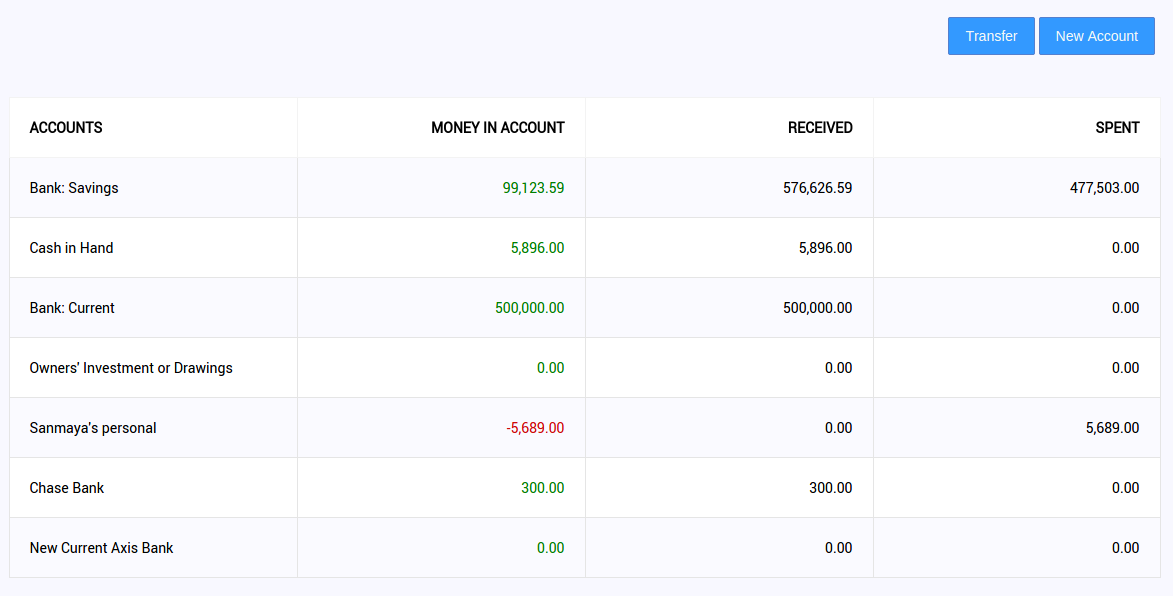

You spent Rs. 3000 from your personal account and received a sales of Rs. 2000 to your account. Now you need to take Rs.1000 back from the company. Step1. Create a new account. Step2. Enter your transaction, choosing your personal account. Step3. See the net balance you need to transfer to your personal account. Now transfer.

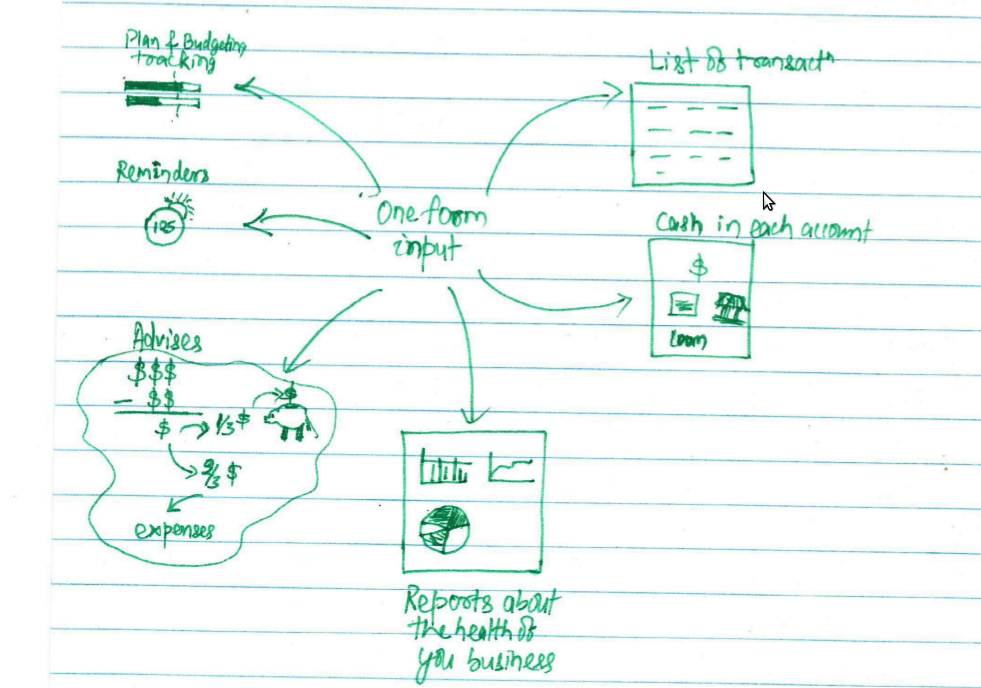

This form saves 300minutes of work per month. If your salary is Rs. 30000pm and thus you save Rs. 937.50 pm. Also if you calculate the search time you spend on, that it simplifies, it saves you Rs. 8000pm which is 10times ROI. And just imagine you may bring another customer in that amount of free time. And we have not included the descision making value it adds with clear advises and report.

SlickAccount suggests few parameters to keep your eyes on i.e. your average income per employee, per administrative employee and per managerial staff, whether your marketing needs some customer segmentation or not.